Companies intending a brand-new ferryboat develop ought to concentrate on the Total Cost of Ownership (TCO) rather than kW-power, in order to enhance prices, Steeprop, a developer and also supplier of azimuth propulsion systems, stated.

Choosing the propulsion device based generally on Capex, as an example, will certainly more than likely boost prices over time, including that a ferryboat proprietor can conserve greater than 2 million euros over a 15-year duration by focusing on the TCO.

“The traditional way of handling the procurement of propulsion systems, among other things, is to request quotations for propulsion units based on one specific value, typically kW-power. The one with the lowest price often wins the bid, contributing to lowering the newbuilding unit cost,” the firm stated.

However, Steerprop stated, we require to think about that the expense of a recently constructed ferryboat composes just a portion of the TCO.

“A ferry and any other vessel are designed to be in service for many years. Therefore, it is important to consider the vessel’s purpose and planned operation when choosing the propulsion solution,” the firm stated.

“Comparing different propulsion system suppliers can be a complicated process when a holistic picture of a ferry’s lifecycle costs is unavailable. For a ferry doing daily repetitive crossings, the TCO is what matters the most. The total cost of ownership includes the newbuilding unit cost, maintenance and spare part costs as well as operational energy costs. The current procurement process focuses only on the newbuilding unit cost, even though the energy costs are by far the dominating factor when we talk about TCO,” Steerprop stated.

Steerprop has actually taken a look at the TCO influence by doing a substitute study of most likely operating situations, where it wished to learn the very best means to make a ferryboat propulsion system.

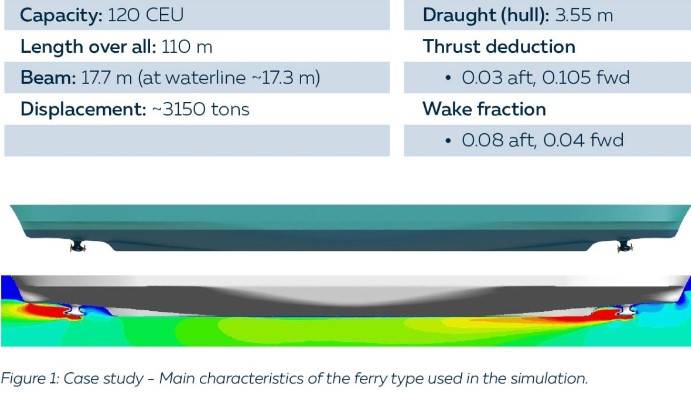

The instance utilized in the research study was a 120 CEU (Car Equivalent Unit) double-ended ferryboat that would certainly work on 4 ferryboat courses of various sizes and also going across times.

In enhancement to the provided vessel attributes, numerous various other variables additionally require to be determined, the firm stated. These variables cover job details, propulsor variables and also functional variables for the going across. Among others, these criteria were utilized:

Project details. This location covered functions such as path size, target going across time, bollard pull demand (optional), which are information normally specified by the proprietor. Ship particular information is after that given by the ship developer, consisting of variation, resistance contour, drive reduction and also wake portion.

Propulsor variables The adhering to criteria were utilized for the propulsor: prop size, RPM and also pitch layout factor, and also propulsion max power. Secondary variables were complementary systems power and also lubrication oil temperature level.

Crossing functional variables When mimicing the going across, these variables were utilized: manoeuvring time and also size at both ends, velocity time and also power, going across rate (knots), slowdown time, consisting of angle and also power of the propulsors. Moreover, the power was divided in between front and also aft devices in all settings.

Steerprop was searching for the overall power utilized for the various crossings (kWh) in the research study. This was enhanced by integrating a certain expense version where interest was provided to the power expense for the going across (EUR) and also the expense of the propulsion device (consisting of preliminary and also upkeep prices). For the overall expense of possession, a 15-year duration was picked. The firm additionally included the opportunity to contrast various propulsion arrangements.

Designing the optimum propulsion device

How to make the optimum propulsion device? The solution, Steerprop states, hinges on the equilibrium in between Capex (Capital Expenditures) and also Opex (Operating Expenses) on the one hand, and also the connection in between power and also torque on the various other. For instance, a propulsion device that has far better velocity abilities or a free-running performance may set you back somewhat much more however lowers power usage dramatically. The obstacle is to discover the very best optimum equilibrium.

“With low power, we gain low Opex, whereas with low torque, we gain low Capex,” Steerprop states.

According to the firm, it is feasible to discover the optimum mix of Capex and also Opex via research studies making use of both path simulation and also expense designs.

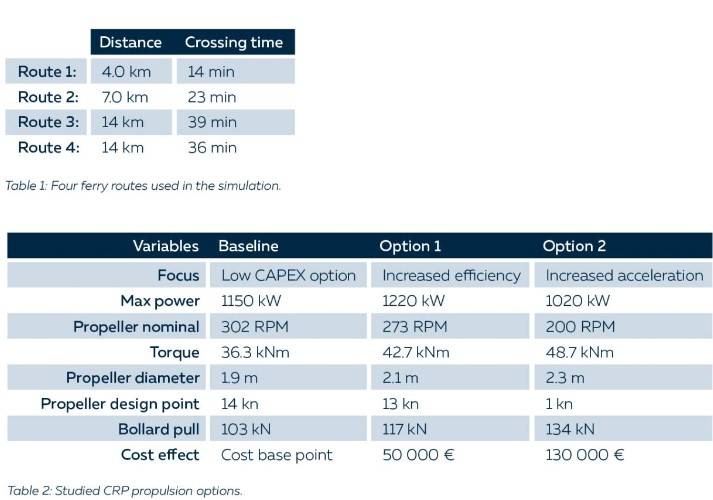

The real simulation was executed making use of 4 ferryboat courses and also 3 CRP (contra-rotating props) propulsion alternatives. The ferryboat courses, consisting of ranges and also going across times utilized, are displayed in Table 1.

The 3 CRP propulsion choices examined are based upon one standard, which is a “standard” remedy meeting the minimum needs.

The 2 various other alternatives concentrate on enhanced performance and also maximized velocity, specifically. These 2 alternatives sustain some added capital investment, however the outcomes reveal that they additionally have a really brief repayment time many thanks to dramatically reduced operating expense. Options 2 and also 3 include various variables contrasted to alternative one.

Table 2 (over) reveals that alternatives one and also 2 utilize a minimized RPM for the prop and also enhanced torque and also a bigger prop size, to name a few points. These 2 alternatives additionally have a greater Capex, however the outcomes reveal that there are additionally considerable yearly financial savings that enhance the overall expense of possession, the firm stated.

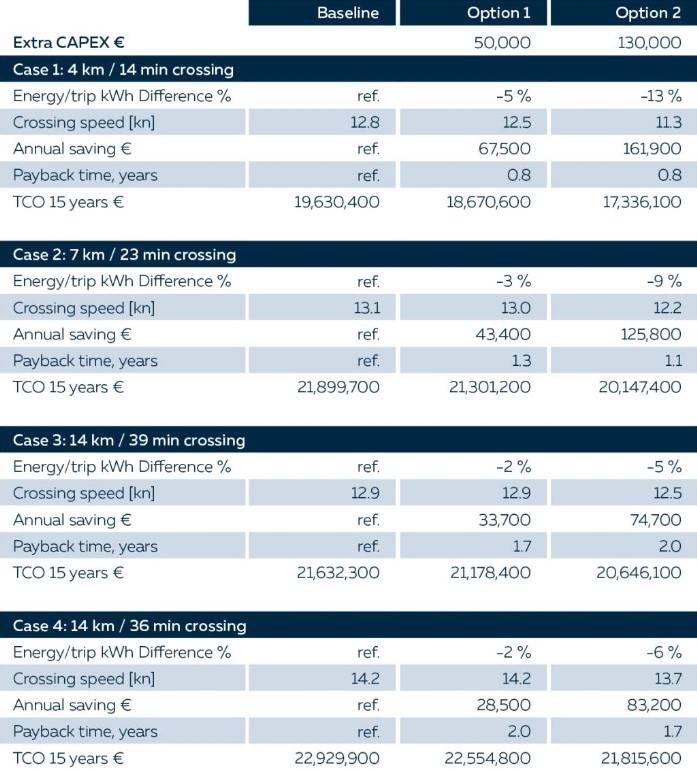

“The results outlined in Figure 2 [below] clearly show that from a TCO perspective, it pays to design propulsion units according to the vessel’s operational profile,” Steerprop stated.

Option 2 eats 13% much less power than the “baseline” alternative on the 14 minute-crossing.

“We can also see clear annual savings for both options on all ferry routes, which vouches for short payback times, especially on the shorter crossings,” the firm stated.

Saving EUR 2.4 M over 15-years

The 2nd alternative, which concentrates on enhancing the velocity stages, advantages ferryboats running brief crossings where velocities take place often. The overall expense of possession in the 4 kilometres going across instance is somewhat over 17,000,000 euros. If we take a look at yearly financial savings going beyond 160,000 euros, we can see that over a 15-year duration, the overall financial savings are greater than 2.4 million euros.

“The simulation results show that operational analysis is the foundation for finding an optimal total cost of ownership. In addition, significant energy savings can be achieved by involving propulsor design as part of the ship design process,” Steerprop stated.

Figure 2

Figure 2